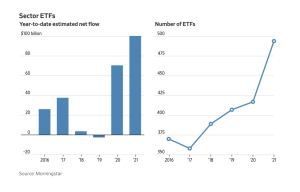

Globally, the past year witnessed unprecedented traction for ETFs, with over $1 trillion in inflows. This surge is indicative of a burgeoning market, with a record number of new issuers introducing innovative offerings. While factors such as the SEC’s regulatory updates and the rise of white-label issuers have played a role, one thing is clear: launching an ETF has never been more accessible, and the demand continues to soar.

Looking ahead, the question arises: what’s next?

We foresee the next wave of growth emerging from an untapped strategy that heralds an entirely new frontier. Historically, ETF activity has been driven primarily from a producer perspective, focusing on baskets tailored to specific investment classes, sectors, or risk profiles. However, the future lies in approaching ETF creation from the consumer’s viewpoint – building baskets around new buyer cohorts and their preferences.

Recent developments offer glimpses of this approach in action. For instance, Proshares’ proposed Metaverse-themed ETF and Alpha Architect’s Gen Z-focused ETF (ZGEN) exemplify this shift towards catering to specific consumer segments. But there is immense potential for further exploration.

Imagine an ETF tailored for sports enthusiasts, comprising companies associated with their favorite NFL franchise – spanning apparel, equipment, electronics, gaming, music, food, and more. Similarly, envision an ETF centered around trending celebrity figures like Taylor Swift, curated around her personal passions that resonate with her fans.

The next phase of ETF growth will be characterized by an outside-in, consumer-driven perspective, as opposed to the traditional producer-driven approach. Successful ETF issuers will align their offerings with buyer profiles rather than predefined investment theses, capitalizing on existing demand.